#Fundbox invoice factoring full#

Once approved, you are able to see a full list of your QuickBooks invoices within your Fundbox dashboard. Fundbox doesn’t require a FICO score to apply. Connect your QuickBooks account to Fundbox in minutes, get a funding decision in hours and get funds as soon as the next business day if approved. Even if you are not experiencing a cash crunch currently, you may want to establish a line of credit, so that it’s available when you need it.įundbox offers a common-sense line of credit that gives small businesses the simple and flexible funding you need to grow. Customers can pay back early with no penalty. 5-.6 percent per week for QuickBooks customers, with a minimum of one week.īlueVine also offers credit lines up to $100,000 in equal weekly or monthly payments, with interest over 6 or 12 months, respectively, to pay it back. In most cases, you can be paid as soon as 48 hours. Customers may get approved for BlueVine’s Factoring offering for up to $2.5 million. Most of the time, your client may not realize he or she is paying a third party, since the payments are made to your business name. Box in your business name, where it will receive payment directly from your client. The remaining portion of the invoice is paid to you directly minus BlueVine’s fees, once your customer pays the invoice. BlueVine’s factoring offering enables you to receive payment for a portion (85-90 percent) of an invoice that your client has not yet paid. This app offers small businesses two options: factoring and credit lines. Please review all your options, and select one based on the needs of your business. 1 While we may provide you with options through our products or services, we are not responsible for their products. Make sure you understand the terms of any loan product before you commit.

Your business will need to meet each provider’s criteria, and each provider will have to underwrite you and your business. These apps may help demystify invoice financing, start up loans and business lines of credit.īefore you get started, your business needs to be in good financial standing, your QuickBooks Online account should be active and your data should be up to date. For apps that offer multiple funding options, the providers will tell you which of their funding products may be available to you, whether it is an advance on unpaid invoices, a new line of credit or a more traditional small loan.

#Fundbox invoice factoring download#

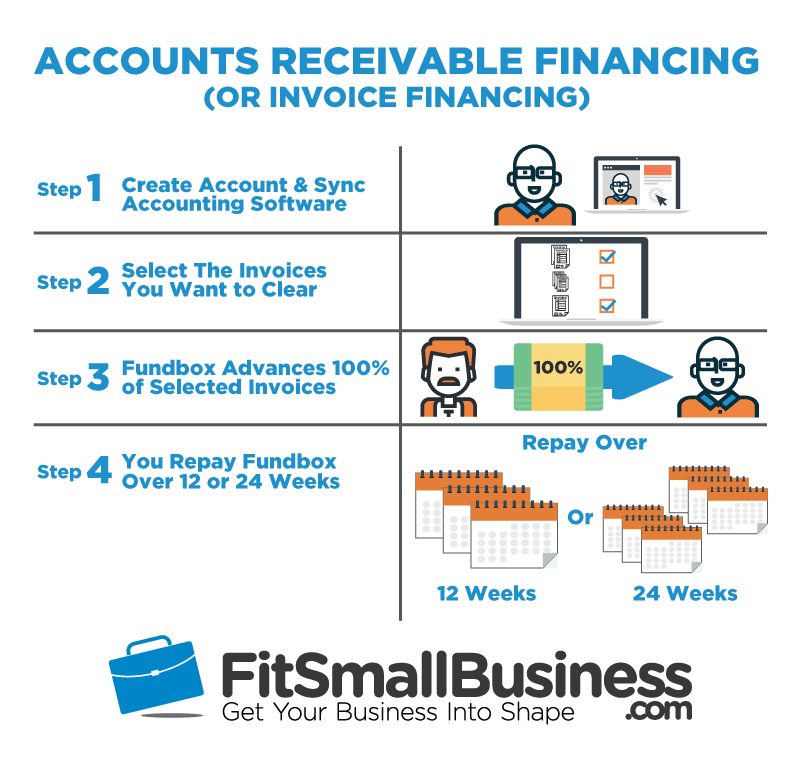

Once you download one of these apps and sync with QuickBooks Online, the app will use your QuickBooks data to tell you if your business may qualify for financing and what your credit limit is. There are three small business financing apps that connect to QuickBooks® Online that can make this process easier: BlueVine, Fundbox and QuickBooks Financing. As you make payments, these funds are available for you to draw again. You have access to a specific amount of financing, but don’t generally make payments or incur interest until you tap into the funds. With some invoice factoring providers, you are selling your invoices to the financial provider.Ī business line of credit is similar to a personal line of credit, such as credit cards or home equity lines of credit, except that the funds are used for business purposes. If your business has large outstanding invoices or receivables where customers pay slowly, factoring can provide you with the funding you need while you are waiting for your customers. Invoice factoring is a fancy name for getting an advance on your outstanding invoices for a small fee. One way to do this is to take out a short-term small business loan through invoice factoring, a line of credit or other types of financing. The key is using a small business loan to survive the crunch. Your business can still be profitable, but have temporary low cash flow. A business can become cash challenged for many reasons – a volatile sales cycle, longer Account Receivable cycles and feeding the needs of a fast-growing business.

One of the most challenging times for any small business is the short-term cash crunch.

0 kommentar(er)

0 kommentar(er)